Top 5 in 2018

January 22, 2018

By

Alyssa Dalton

Automation experts predict the top trends and technologies coming to your plant floor

Photo: PhonlamaiPhoto/iStock/Getty Images Plus

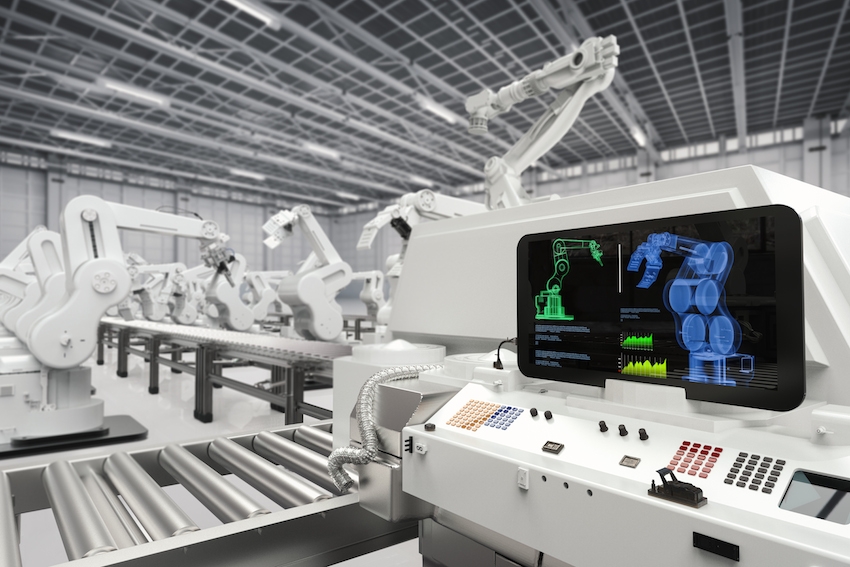

Photo: PhonlamaiPhoto/iStock/Getty Images Plus Jan. 22, 2018 – What do you see when you look into the manufacturing crystal ball? It’s a Manufacturing AUTOMATION tradition to highlight the top five trends and technologies to keep an eye on at the start of a New Year. Read on for expert predictions about the impact of Big Data analytics, the Digital Twin, artificial intelligence and more.

Craig Resnick is the vice president of ARC Advisory Group. He covers automation supplier and financial clients, with more than 30 years of experience in marketing, business development, and strategic planning. He graduated Northeastern University with an MBA and BS in Electrical Engineering.

1. Better systems and connectivity at the edge, improving real-time decision making

As more data-intensive compute workloads are pushed to the edge, real-time remote management and a simplified edge infrastructure are crucial for success. Operational issues, such as managing asset performance to improve production while reducing unplanned downtime, will drive end-users to deploy edge computing. The companies who are quick to take advantage of self-managed, edge computing infrastructures will be able to unlock the data that has long been stranded inside machines and processes. They will also be able to quickly identify production inefficiencies, compare product quality against manufacturing conditions and pinpoint potential safety, production and environmental issues. Remotely managing this edge infrastructure will immediately connect operators with off-site experts to more quickly resolve, or better yet avoid, downtime events. This will free operations personnel and IT staff to perform their respective roles versus distracting them from their fields of expertise.

2. Further advances in industrial cybersecurity management solutions

Additional advances in industrial cybersecurity management solutions for maintaining a facility’s security posture will be deployed to address the unique features of industrial automation equipment. These solutions will further address the special requirements of industrial plants — in particular, the stringent constraints on system updates and network communications. They will incorporate commercial-type IT cybersecurity management solutions but in a manner that limits any negative impacts on control system operation.

More importantly, these new industrial cybersecurity management solutions will extend this functionality to include unique, non-PC-based industrial assets and control system protocols. These solutions will also recognize and manage industry-specific cybersecurity regulations, such as NERC CIP and leverage new integrated strategies that combine IT, OT and Industrial Internet of Things (IIoT) security efforts, maximizing the use of all corporate cybersecurity resources.

3. Open process automation vision gains additional traction

The open process automation vision will gain additional traction, adding new end-user and supplier members. Initiated by ExxonMobil and The Open Group, the vision of this initiative is specifying the process automation system of the future that minimizes vendor-specific technologies and increases return on system investment while maintaining stringent levels of safety and security. This would be achieved by specifying highly distributed, modular, extensible systems based on standards-based architecture for interoperable components with intrinsic cybersecurity. The objective of this vision is to eventually replace large CapEx automation retrofit programs with smaller OpEx programs that require less analysis, engineering and planning. Updates to these new open systems will be managed as a maintenance activity. As well, these new systems will consist of smaller, more modular and more easily distributed components, helping to better empower technical personnel while reducing the level of training required and facilitating additional benefits through collaboration.

4. The merging of virtual and physical worlds will create new business models

An integral part of the digital transformation are the technologies that accelerate the merging of the virtual and physical worlds, enabling the creation of new business models. Manufacturers are introducing new business models where they sell digital services along with products. An example of these services is the selling of the Digital Twin, which is a virtual replication of an as-designed, as-built and as-maintained physical product, augmented by providing real-time condition monitoring and predictive analytics. Customers use the equipment and products along with maintenance and operational optimization services based on predictive and prescriptive analytics. Augmented reality (AR) technologies are used to connect virtual design to physical equipment for operator training and visualization, as well as for machine maintenance. Thanks to the IIoT, the Cloud, Big Data and operational analytics, machine pattern recognition can be achieved by data mining and statistics, enabling artificial intelligence (AI) technologies that teach machines to make operational changes without the need for programming.

5. Distributed analytics extending data processing and computing at data source

IIoT-enabled distributed analytics will further extend data processing and computing close to or at the data source, typically though intelligent, two-way communication devices, such as sensors, controllers and gateways. In many instances, the data for distributed analytics comes from IIoT devices located at the edge of the operational network. These devices can be located near or embedded in a wide variety of edge machines and equipment, such as robots, fleet vehicles and distributed microgrids. The analytics can be embedded within distributed devices or created in a Cloud environment and then sent to the edge for execution. From an operational perspective, security, privacy, data-related cost and regulatory constraints are often the reasons cited for keeping the analytics local.

In terms of benefits, distributed analytics can help support revenue generation from new methods of serving existing customers and ways of reaching new ones; asset optimization through improved, proactive, and highly-automated management of infrastructure and resources; higher satisfaction and retention by engaging customers with high value products and services where and when they need them; and improved operational flexibility and responsiveness through better and faster data-driven decisions.

Kimberly Connors is EY Americas Technology Solutions leader, and Canadian Advisory Technology leader. With more than 25 years of experience, she has consulted with major corporate and mid-market clients across North America, leveraging technology to drive business value and insight, and optimize IT operations.

1. Digital Twins for predictive maintenance

Today, leading companies are already using an augmented reality Digital Twin to bridge the virtual and physical worlds of manufacturing machines and systems. By adding continuous monitoring — enabled by the IoT and AI algorithms — operators will be able to predict, identify and address potential problems on plant floors before they happen. Taking it a step further, this technology can allow voice-controlled access to experts who will be able to see a live stream of what the operator is seeing, providing even greater productivity.

2. OT and IT convergence requires increased cybersecurity

Many manufacturers have introduced new technologies to drive improvements in areas such as production and supply chain efficiency, and asset management, but the increasing connectivity of previously isolated manufacturing systems — together with a reliance on remote supporting services for operational maintenance — has introduced new vulnerabilities for cyber attacks. Manufacturers need to become increasingly focused on closing these vulnerabilities.

3. IIoT for asset utilization

The IIoT was initially about generating increased productivity, operating and energy efficiency, and accuracy. Now it’s about generating information, driving improved customer outcomes, enhancing responsiveness to customers and ecosystem partners, producing higher levels of product performance, and finding new revenue streams. As things become increasingly intelligent and connected, there’s a competitive necessity for manufacturers to “listen” to the IIoT and use the generated data to create actionable insight. The IIoT allows for the synchronization of information, enabling different parties in different locations to have access to the same information at the same time. Although the process of becoming a manufacturer driven by Big Data analysis is far from simple, the potential benefits are vast.

4. 3D printing for cost reduction

Any physical product runs the risk of being disrupted by 3D printing. At its simplest, 3D printing is analogous to a teleporter — able to transmit the designs of any product instantly to any printer in the world. If 3D printing delivers on even a fraction of its disruptive potential, it will still mean the upturning of a whole range of business and industrial landscapes. Companies need to start thinking now about how to get ahead in order to capitalize on its disruptive potential.

5. Blockchain for greater operation visibility

The ability to deliver real-time information to customers is one of today’s biggest success factors, yet it is also one of the most significant challenges for manufacturers. Customers are looking for timely and accurate information, wherever and whenever they want it. Blockchainvcan permit end-to-end, IoT-enabled chain-of-things across scanners, transponders and other devices. Further, dashboards can provide access across all stakeholder groups — internal, corporate customers as well as consumers — creating a tangible real-time solution to solve the visibility problem.

Matthew Littlefield co-founded LNS Research in 2011 and is now president and principal analyst. In this role he oversees LNS’s coverage of the industrial value chain. Dan Miklovic joined LNS Research in May 2014 and is a research fellow with his primary focus being research and development in the Asset Performance Management (APM) and Operational Architecture practices.

In the world of IIoT and digital transformation for industry, the past year has been one to remember. Many will look back as this being the year where we passed peak hype and moved from talking about the realm of the possible to practical. Despite some high-profile setbacks for vendors in the space — there is still more positive momentum than negative — LNS Research believes there will be many vendor and end-user winners as we move into a post-peak hype era.

From Matthew Littlefield:

1. Large industrials reinvent operational excellence with Big Data analytics

The industrial space has always been characterized as insular, organic and conservative in how we approach the adoption of technology and process improvement techniques. Lean manufacturing was developed out of the Toyota Production System. Six Sigma was developed out of Motorola and GE. However, as these methodologies spread, they became hardened — and in some circles even turned to dogma — meaning as technology advanced, the process itself couldn’t change without severe repercussion and criticism.

We predict 2018 will be the year this dogmatic approach breaks down, and a new breed of large industrial companies will emerge and publicly prove through improved best-in-class results that a new approach to Lean and Six Sigma is needed to fully capture the potential benefits of Big Data analytics in manufacturing.

2. IIoT platform adoption gains critical mass by industry

Last year we predicted that 2017 would be the year where the industry saw IIoT platform providers move from pilot to enterprise rollouts with more than one vendor going on the record with customers making enterprise

commitments.

In 2018, we believe it will be the year that some of the platform players gain critical mass — i.e. gain multiple major customers on the same multi-tenant platform with shared services and apps running across. There will however be some caveats. Each end-user will have multiple platforms for multiple use cases and inter-Cloud connectivity will become both a requirement and reality. We also believe that IIoT platforms (not including Cloud platforms like Microsoft Azure and Amazon AWS) will have to differentiate on subject matter expertise and relevance.

3. Edge and Cloud both have record years

Microsoft Azure and Amazon AWS have emerged as two Cloud leaders for the industrial space and are delivering record results for shareholders. At the same time, edge is sexy again, and there have been a slew of nextgen startups focused on the industrial edge and delivering new analytics as close to the data source as possible. We believe 2018 will be the year the industry realizes that a hybrid analytics approach really means that both edge and Cloud are growing markets and there is more than enough business for both types of vendors to have record years.

From Dan Miklovic:

4. APM becomes all about business

Ever since the advent of APM, the focus has been on improving reliability, decreasing downtime and reducing unplanned maintenance. Most of this has been predicated on the premise if “it’s” broken “it” can’t be contributing to the business.

We predict 2018 as being the year we see a shift in focus toward actually optimizing the profitability from equipment. Machine learning and better Big Data analytics will enable business to decide the best operating profile for the plant based on the order backlog, reliability issues and the Digital Twin model of the plant.

5. Digital Twins in 2018 simulate possible futures

To date, much of the hype around Digital Twins in asset-intensive industries has been about maintenance-focused applications such as superimposition of operating conditions on virtual x-rays of the equipment to aid technicians in diagnosis or using the twin to model expected service life.

In 2018, we expect the Digital Twin focus to shift to include not just the physical aspects of the twin but the process aspects as well. This will drive new interest in process design and engineering applications, so changes in operating performance required to facilitate reliability can be assessed for production impacts, as noted above.

This article was originally published in the January/February 2018 issue of Manufacturing AUTOMATION.

Advertisement

- Montreal’s AI hub attracts top global talent

- Honeywell Cloud Historian analyzes data across multiple sites