Additive manufacturing moves into production

February 11, 2021

By Jacob Stoller

The rapid evolution of 3D printing technology for both plastics and metals is creating new opportunities, however finding solid business cases remains a challenge

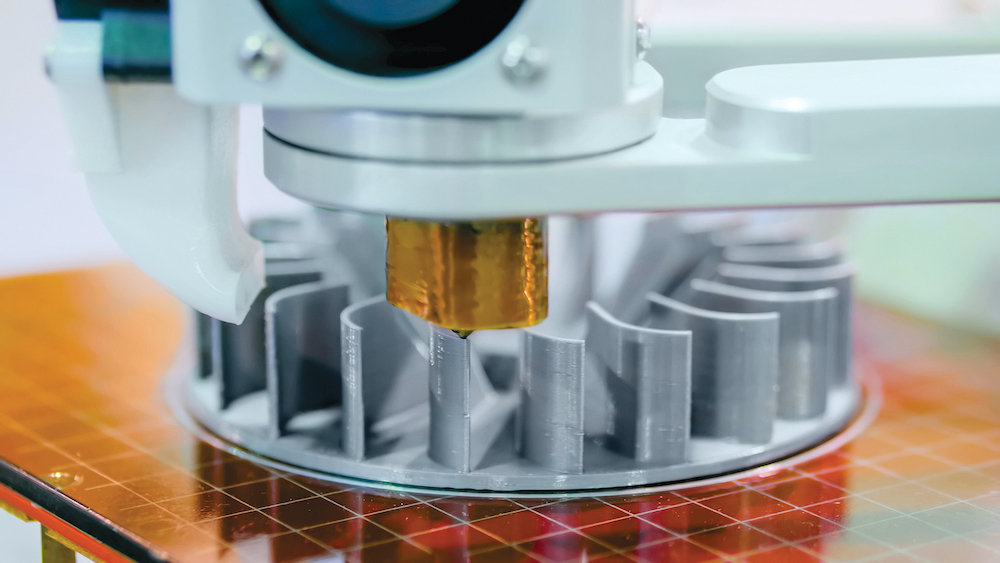

Photo: Zyabich/Getty Images

Photo: Zyabich/Getty Images The phrase “my kid could make that” is now literally applicable to millions of plastic shapes, thanks to the wide proliferation of consumer-grade 3D printers.

The apparent ease of printing a finished product directly from a digital model with no moulds or tooling, however, has caused many to underestimate the challenges and the costs of applying the technology in production environments.

This is particularly problematic in AM (additive metal) manufacturing, where the barrier to entry is much higher than it is for plastics.

“Additive is a unique process, and I think it’s probably one of the most over-hyped technologies in the world,” says Peter Adams, president and CEO at additive manufacturer Burloak Technologies, “and I truly believe that this is creating a major misunderstanding of the technology. And that is causing a lot of people to invest money that they never would have to put at risk if they asked the right questions.”

Understanding capabilities

The most common misconception is that 3D printing is a viable cost-cutting replacement for machining and other traditional methods. “If you say, ‘let’s go and print this and see if we can get it cheaper than we can with a CNC machine,’ then you’re on the wrong path,” says Adams, noting that his company frequently advises prospective clients to continue making parts the same way they’ve been making them.

“3D printing is slow,” says Gilles Desharnais, CEO of Montreal-based additive manufacturer Axis Prototypes. “You’re building 20-micron layers or 40-micron layers at a time. Your machine might cost a quarter of a million dollars, and the material cost is ten times higher than feedstock you normally use for machining. So when somebody comes up to you and says, ‘I machined this today, and I want to 3D print it,’ the probability that the business case will fly is maybe 0.1 per cent.”

The apparent ease of printing a finished product directly from a digital model with no moulds or tooling has caused many to underestimate the challenges and the costs.

That said, 3D printing is a game-changing tool, and additive manufacturers like Burloak and Axis are making important inroads in the marketplace. The key is identifying areas where the advantages of additive over other methods create opportunities to produce a unique product or part that solves a particular problem.

“You really have to look for opportunities where you’re taking advantage of the design liberties that 3D printing gives you,” says Desharnais, “and this is where design for additive manufacturing (DfAM) comes in. So a lot of people have to look at ‘what does the capability of additive give me?’ And that applies to plastics as well as metal.”

Uses in design

An important example is parts consolidation, where additive’s unique ability to fabricate complex shapes and geometries allows manufacturers to create assemblies with fewer components. Another is the ability to produce more efficient designs that improve performance or reduce weight.

“I think aerospace and space in particular are obvious sweet spots,” says Adams. “You’ve got a high-complexity, highly engineered product, and you’ve got opportunities for mass reduction. Parts consolidation takes away risk and solves problems.”

A classic example is a fuel nozzle assembly developed by GE Aviation, which is now widely installed on its LEAP aircraft engine. This reduced the parts count from 20 to one, is lighter, and five times more durable. Fewer parts and higher durability reduce maintenance costs and improve safety, and lighter weight improves the efficiency of the aircraft. These advantages justify the much higher costs of additive fabrication.

Additive is also being used, interestingly, help improve the efficiency of machining operations by creating better tooling. Drill bits with cooling channels, for example, allow operators to reduce the cooling time in drilling operations.

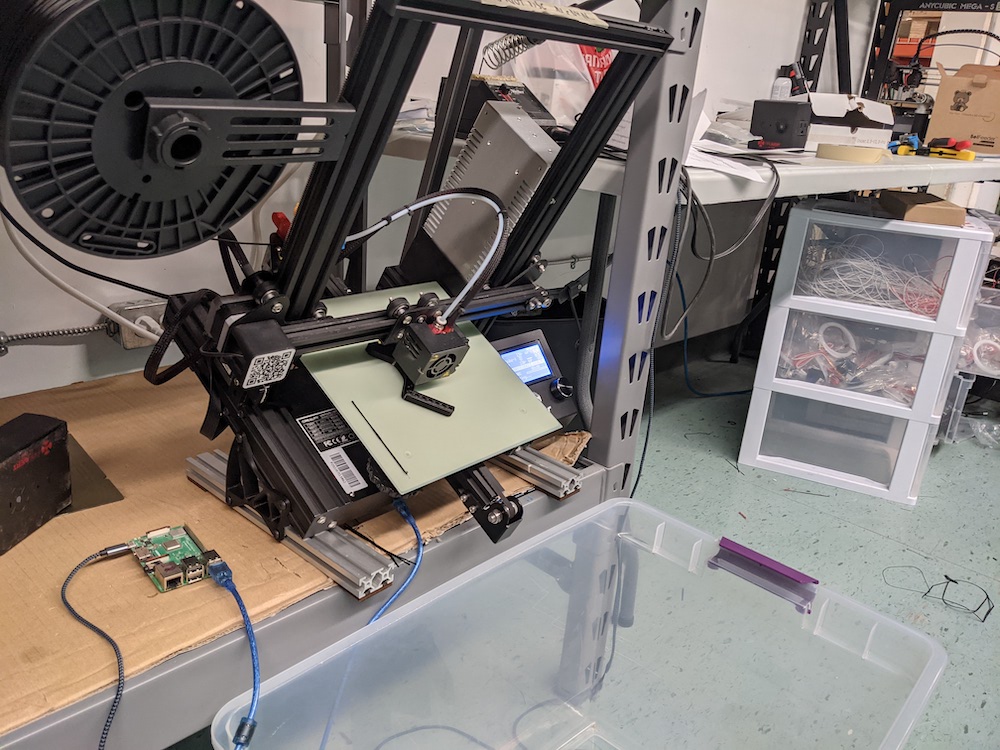

Sienci Labs, a Waterloo-based startup that manufactures CNC equipment for woodworking, found that plastic parts could be economically fabricated by a farm of $300 consumer-grade printers. Photo: Sienci Labs

Medical applications

Many of the best-known additive solutions involve medical implants and prosthetics, which must not only match the contours of an individual human body, but may be required to have complex surface textures. A unique example is an improved spinal implant using lattice construction, which allows tissue to grow into it.

“Printing is probably the only way to create a true 3D lattice,” says Mark Kirby, industry training manager at the Multi-Scale Additive Manufacturing Lab at University of Waterloo, “and the spinal cage that has a true 3D lattice throughout it is now considered the gold standard for spinal cages.”

As the technology improves, Kirby predicts we may soon see a day when individual hospitals can produce implants such as hip replacements on demand using 3D printing. “If I print on demand, I don’t have to have 100,000 hip replacements in a warehouse, and I don’t have to ship them around the world,” he says.

High-volume capability is also beginning to enter the picture. Last summer, Winnipeg-based manufacturer Precision ADM used 3D printing to mass-produce three million plastic nasopharyngeal swab sticks for COVID-19 testing, the largest production run for 3D printing in history. The key business advantage was time – gaining approval requires many iterations with regulators such as Health Canada, a stage that would have taken many months if injection mould tooling had to be created each time.

While saving lives was the overriding requirement, Kirby points out, the project also shows that 3D printing can be economical at high volumes. “On a unit cost, the injection-moulded parts would be cheaper,” says Kirby, “but if you look at the lifecycle cost with the tooling in there and factoring in the delay time, 3D printing makes economic sense.”

Moving forward

The number of opportunities to apply the technology is growing exponentially as the technology improves. As Desharnais points out, there were only six materials for printing plastics in 2009, and today, there are hundreds if not thousands. Today, we’re seeing additives like carbon fibre, fiberglass, wood fibre, and graphene, which is used to make conductive plastics.

The low cost of plastic printers is also creating opportunities. Sienci Labs, a Waterloo-based startup that manufactures CNC equipment for woodworking, found that plastic parts could be economically fabricated by a farm of $300 consumer-grade printers. Sienci is also implementing low-cost equipment for automatically unloading the printers, reducing the labour component.

“If you’re a start-up like us, it’s much cheaper to build a 3D printer farm than to pay for all the moulds and then do all the engineering,” says Andy Lee, Sienci’s CEO, “because we have no idea how many parts we’re going to need, or if there are going to be any changes made in between. We’re also in kind of a sweet spot because we order all the filament material in bulk.” Once volumes increase and the product reaches maturity, he says, the company will likely switch over to injection moulding.

“People forget that additive is a tool, so it’s going to fit into a solution.”

The plethora of options makes it almost certain that the technology will alter the competitive landscape in many, if not all, areas of manufacturing. To capitalize on opportunities, manufacturers will not only have to experiment with the technology, but look carefully at their designs and processes to see where traditional methods might be holding them back.

“People forget that additive is a tool,” says Frank DeFalco, director of member relations for the supercluster Next Generation Manufacturing Canada, “so it’s going to fit into a solution. Very, very rarely will it be a standalone solution. So, it’s all about a journey of understanding the redesigning of a solution.”

Part of this is understanding how additive machines behave, which is often different from what appears on the screen. “The best way to learn the language is to buy, maybe, a $2,000 printer and start to experiment,” says Kirby. “That way, you’ll be part of the business conversation.”

There is no textbook for applying 3D printing, and with the explosion of new options, there are limitless avenues to explore. The key is starting the learning process. “I think if you have no 3D printing capability at all,” says Kirby, “you’re going to limit the kind of conversations and the kind of business interactions that you’re likely to have going forward.”

Jacob Stoller is a journalist and author who writes about Lean, information technology and finance.

This article appears in the February 2021 issue of Manufacturing AUTOMATION.

Advertisement

- Schneider Electric updates EcoStruxure Automation expert

- Ont. manufacturers receive nearly $6.5M to implement new technologies