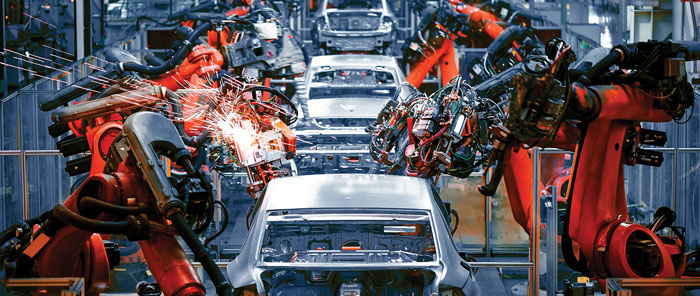

Editorial: Advanced manufacturing key to Canada’s post-COVID future

May 7, 2021

By

Kristina Urquhart

Photo:

xieyuliang/Getty Images

Photo:

xieyuliang/Getty Images It was welcome news at the end of March when French-owned pharmaceutical giant Sanofi announced plans to construct a $925-million influenza vaccine manufacturing facility in Toronto — though not only for the new jobs it would bring, or the economic boost it would inject into a challenged economy coming out of COVID-19.

It also wasn’t only about Canada having domestic vaccine production in the event of another pandemic — though that is very welcome news indeed. No, Sanofi choosing to add another facility in Canada when the company also has a presence in 99 other countries showed the world that Canada is worth investing in.

Consider this: a recent report on the future of Canada’s post-pandemic supply chain targets the advanced manufacturing sector as a prime market for growth — and a place where new automation solutions can take centre stage.

Invest in Canada, a federal body charged with attracting foreign investment, commissioned KPMG to analyze which of the country’s supply chains offer the best opportunities. The study, called “Advantage Canada: Reshaping Supply Chain Investment Opportunities After COVID-19,” identified advanced manufacturing, clean technology and agribusiness as the three sectors most attractive to foreign investors.

Advanced manufacturing in particular is primed for expansion: 40 per cent of manufacturers in Canada use advanced technologies, and GDP growth in advanced manufacturing was 3.7 per cent between 2017 and 2019.

The pandemic highlighted just how much risk global supply chains are under — the reliance on low-cost production with “just-in-time” delivery has, over time, led to offshoring, with “lean” distribution centres located closer to end customers. While manufacturers have been able to save on cost of labour by driving production away from Canada, the product bottlenecks felt during the COVID crisis revealed there can be hidden costs to operating with long supply chains.

As global supply chains shift to more regional or local ones, they’re establishing “micro supply chains” that bring products and supply networks closer to customers, cutting down on delivery costs and reducing supply chain shortages.

Sanofi choosing to add another facility in Canada when the company also has a presence in 99 other countries showed the world that Canada is worth investing in.

“Companies are changing their operating strategy from focusing on low-cost jurisdictions to strategic locations with stable business environments,” the report authors say.

They say potential investors should consider Canada as they redistribute their supply chains because it is a stable democracy and has trade agreements in place with North America, South America, Europe and Asia. Canada offers access to water, energy and other resources, and employs a high-talent workforce as a result of quality post-secondary schools and open immigration.

There are policies in place to protect intellectual property, and the made-in-Canada brand is recognized around the world as one of high standards. Canada is also home to manufacturing sectors that have a high labour force but need reinvention, such as aerospace and automotive.

KPMG estimates that Canada’s proximity to consumer markets here and in the U.S., its resource advantages and the shift to supply chain regionalization could translate to over US$930M in investment for the Canadian market over the next 14 months.

Advanced manufacturing in particular is primed for expansion: 40 per cent of manufacturers in Canada use advanced technologies, and GDP growth in advanced manufacturing was 3.7 per cent between 2017 and 2019.

There are still supply chain risks for investors to be aware of such as border closures, which at the time of this writing have been in effect since the beginning of the pandemic. Ongoing geopolitical issues with the U.S. and China and the ensuing unpredictability could possibly affect Canada’s export markets.

But the benefits outnumber the risks, says KPMG — and the quick response of the manufacturing supply chain to retool and produce medical equipment and supplies needed for COVID-19 means there are key investment opportunities for international automation vendors as well. The concentration of manufacturers and suppliers between the Windsor-to-Quebec corridor allows for direct access to OEMs while still being close to Canada’s biggest consumer bases.

The new Sanofi plant, for example, will create 1,225 jobs by the time it is completed in 2027. But an entire ecosystem of suppliers will be required to get the construction and machine building underway, and to support it once it’s up and running.

Good news for the automation suppliers here at home: you’re already invested in Canada. Time to start preparing your bids.

This article appears in the May 2021 issue of Manufacturing AUTOMATION.

Advertisement

- Robot orders surge in North America in Q1 2021

- FANUC America debuts new model of LR Mate tabletop robot