Report: Test and simulation market to challenge traditional automotive manufacturers

January 31, 2020

By Manufacturing AUTOMATION

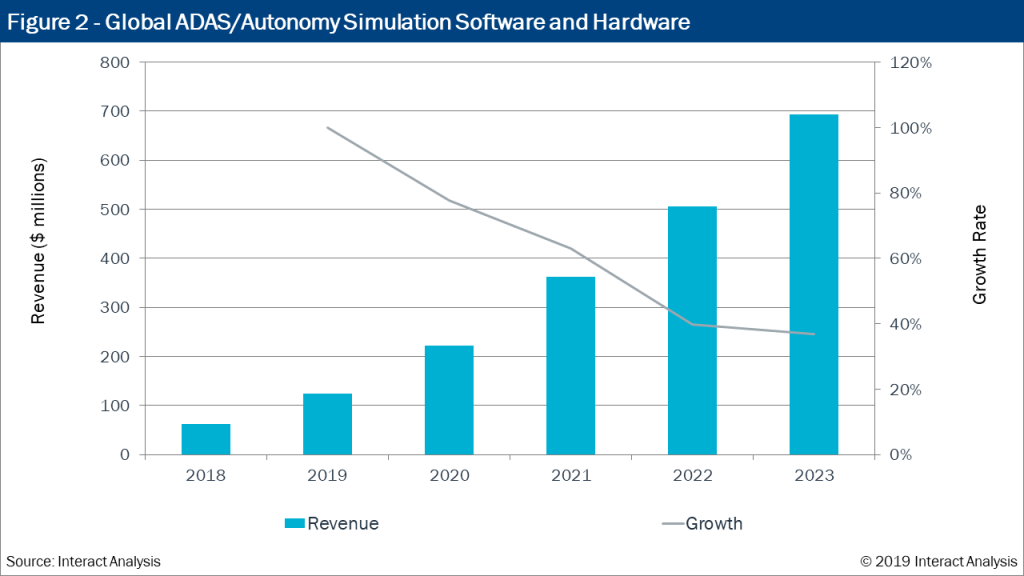

Global ADAS/Autonomy Simulation Software & Hardware. Photo: Interact Analysis

Global ADAS/Autonomy Simulation Software & Hardware. Photo: Interact Analysis Investment in automotive design, test and simulation solutions is going to increase 11 per cent in the next five years, according to a new report by Interact Analysis, a UK-based intelligent automation research firm.

The report estimates that the global automotive design, test and simulation solutions market was worth around $5.1 billion in 2018, and forecasts a compound annual growth rate (CAGR) of 11 per cent to $8.6 billion in 2023.

This new market segment combines traditional software design tools such as product lifecycle management (PLM) with test solutions and new, advanced simulation tools being used to model autonomous vehicles and their behaviour.

This growth runs concurrently to major changes in the global automotive market, as OEMs attempt to keep up with major changes in consumer use habits and legislation.

The report outlines how three major trends – electrification, autonomy and mobility – have emerged, forcing the entire automotive community, from raw material suppliers to aftermarket service centres, to rethink their strategies, products and futures.

Focus on design solutions

OEMs are, the report states, facing major pressure on traditional sources of profit like the manufacturing or servicing of cars. Instead, they are looking to simulation solutions to speed up design processes and bring products to market far quicker than before.

This is due in part to a new breed of OEM, who are not constrained by legacy processes, costly manufacturing facilities or shareholder oversight.

There are two main approaches to this: first, using simulation to reduce the need for physical prototypes and testing, and second, bringing simulation much earlier into the design process to help constrain and better define the end-product from the very start.

“The days of cars being seen as ‘heavy metal’ products are now in the past,” says Alastair Hayfield, research director for Interact Analysis and the report’s author. “Most of the value in a modern car is electrical and the software used to control the functionality of the vehicles is among the most complex ever developed by humans.

“This step-change in design and functionality has attracted new market entrants from high tech industries, which has in turn brought new pressures on the established players to increase their capabilities, and quickly.

“Investing in automation solutions will help bridge that gap. OEMS and suppliers which adopt simulations, for example, should find it possible to reduce development costs and improve their time to market.”

Advertisement

- Hardy Process Solutions introduces single-channel weight processor for PROFINET

- Manufacturing companies named to Forbes list of top employers