Report: Tariff fears and economic uncertainty weigh on Canadian manufacturing in January

February 3, 2025

By Manufacturing AUTOMATION/ S&P Global Canada Manufacturing

Despite a slight decline in the PMI from December, Canadian manufacturers continue to experience growth, but face mounting concerns over the potential impact of U.S. tariffs on exports.

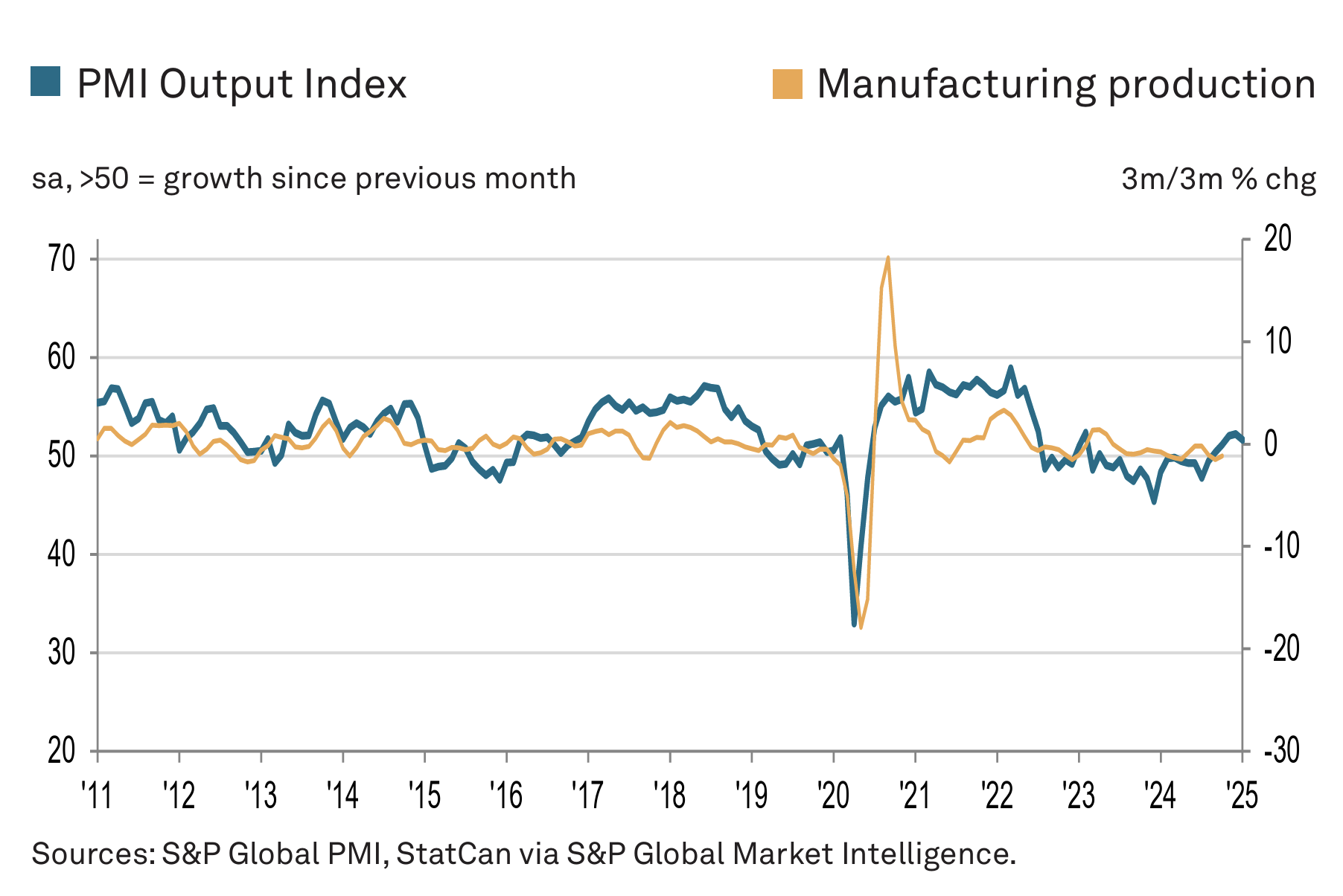

Operating conditions in Canada’s manufacturing economy improved modestly in January. The seasonally adjusted S&P Global Canada Manufacturing Purchasing Managers’ Index (PMI) recorded 51.6 in January. This indicates a modest expansion rate. It was down since December when the PMI registered 52.2. That said, the headline index has now recorded above the crucial 50.0 no-change mark for five months in a row.

Growth rates for both production and new orders softened, while confidence in the outlook sank to its lowest level since last July. While the potential for tariffs on Canadian manufactured goods exported to the United States was reported in some instances to have led to the bringing forward of orders, uncertainty over the scale and extent of tariffs led to hesitation and doubt within the marketplace and amongst manufacturers themselves.

Production rose again in January, in line with the trend since last October. The latest expansion was partially linked to higher sales. The latest data showed that new orders rose, supported by an increase in new export sales for the first time since August 2023. Anecdotal evidence suggested that the threat of US tariffs had led to some clients bringing forward orders. However, uncertainty and hesitation were also widely reported across product markets, largely over the extent of U.S. tariffs and how the possibility of a global trade war could impact economic activity. Subsequently, new work overall rose only modestly and to the weakest extent in three months.

Commenting on the latest survey results, Paul Smith, Economics director at S&P Global Market Intelligence said, “January’s survey highlighted the complex impact that possible U.S. tariffs are presently having on the Canadian manufacturing economy. Firms noted that clients in some instances were bringing forward their orders to get ahead of these potential tariffs, and output amongst manufacturers was being raised in response. Firms even took on additional staff to help service additional workloads, and this helped them to keep on top of their current orders.”

Tariff concerns also weighed on the confidence of manufacturers. Although firms are hoping to bolster output in the year ahead as they plan to release new products, business expectations have been at their lowest since last July. Such uncertainty led firms to take a circumspect approach to purchasing activity, with firms reducing their input buying to the greatest extent since last August.

With production rising to a greater extent than new orders, manufacturers added to their warehouse inventories during January. Growth was modest and down on December’s record increase, however. Some firms noted challenges in shipping out goods, due to ongoing difficulties in sourcing transportation and poor weather conditions.

A modest increase in staffing levels was recorded in January, extending the current period of growth to five months. Open positions were reported to have been filled, whilst there was some recruitment in reaction to higher sales and production requirements. Firms were subsequently able to keep on top of their workloads as signalled by another cut in work outstanding. Backlogs have now been reduced consistently throughout the past two-and-a-half years.

Finally, input price inflation accelerated in January to a 21-month high. A stronger US dollar was reported to have raised the price of imported goods, according to panellists. Output charges rose in response, with inflation also picking up to its highest level since last August.

- KION Group, Accenture and NVIDIA optimize warehouse automation with AI and digital twins

- CME welcomes U.S. tariff delay, urges governments to focus on long-term economic growth