Companies are investing in big data, ERP and IoT: survey

June 21, 2017

By IFS

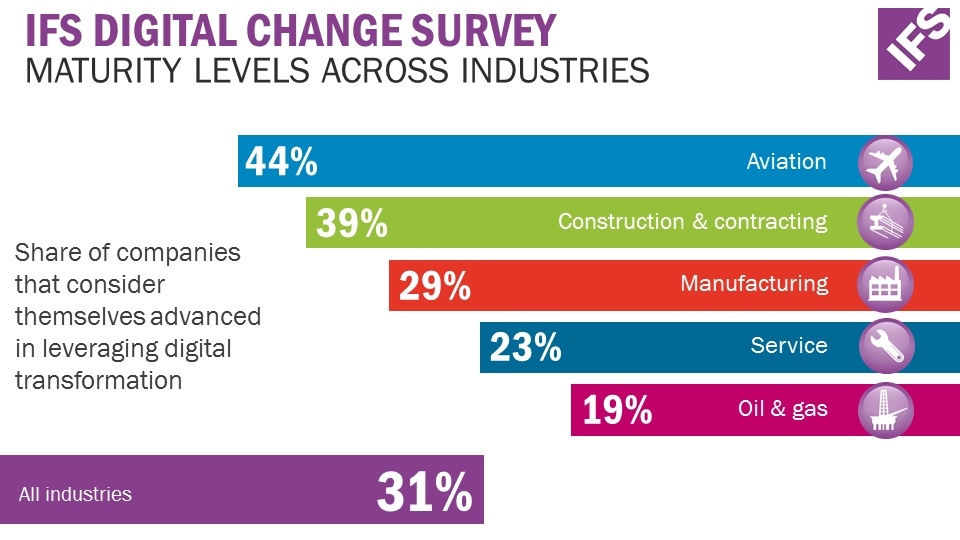

Jun. 21, 2017 – According to IFS’ Digital Change Survey, the manufacturing and construction industries are moving toward digital maturity while the oil and gas industry lags.

The survey polled 750 decision makers in 16 countries, including more than 120 in North America, to assess the maturity of digital transformation in a range of sectors such as manufacturing, oil and gas, aviation, construction and contracting, and service.

North American companies are adapting quickly to a digital transformation

According to survey findings, organizations in North America are pursuing a digital transformation by upskilling existing talent (61 per cent); investing in digital resources, technologies and assets (46 per cent); and through external recruitment of digital talent (nearly 39 per cent).

“Companies all over the world now understand the urgency of digital transformation,” said Antony Bourne, VP of global industry solutions, IFS. “In fact, more than three quarters of North American respondents, alone, either ‘agree’ or ‘strongly agree’ that their company has the culture and structure in place to adapt quickly and effectively to a digital transformation. They are relying on innovative technologies along with relevant industry expertise to guide them in the right direction.”

Internal process efficiency is driving North American investment

Identifying internal process efficiency as the No. 1 driving force behind digital transformation, North American companies in all industries are looking to invest in the following areas:

• Big data and analytics (46 per cent)

• Enterprise resource planning (ERP) software (41 per cent)

• IoT (37 per cent)

However, survey respondents in North America noted that the top barriers to digital transformation have been aversion to change (36 per cent) and security threats/concerns (36 per cent), followed by lack of standard processes (35 per cent), and legislation and compliance (35 per cent).

Servitization is making North American manufacturing more competitive

North American manufacturing companies, specifically, are ahead of the curve with respect to servitization — especially compared with their global counterparts. Forty per cent of North American respondents say that servitization is well-established at their company and is already paying dividends, compared to only 25 per cent globally.

Furthermore, 45 per cent of North American respondents say the move to servitization has given their company a competitive advantage and enabled them to increase market share and grow existing accounts, compared to only 27 per cent of respondents globally.

Service providers in North America anticipate challenges in modernizing but they have a plan

Service providers in North America are fighting an uphill battle to modernize – with companies in Canada and the United States finding customer demand for self-service and collaboration tools (67 per cent) and remote diagnostics / remote service providers (63 per cent) a challenge.

According to 74 per cent of North American survey respondents, recruiting, training and retaining skilled technicians has been a key inhibitor to growing service revenue, as have inadequate or disconnected systems and processes (63 per cent). In fact, 81 per cent of North American survey respondents say they are concerned about the sustainability of their current cost model.

BIM and workforce automation will be key investments

North American construction and contracting companies are prioritizing investment in building information modelling (46 per cent) and workforce automation (38 per cent) in 2017. Only 23 per cent think their company has responded successfully to customer demand — compared to 20 per cent of respondents globally.

What’s inhibiting projects in this sector? According to nearly 77 per cent of North American respondents who agree or strongly agree, “reconciliation of internal and external ERP systems in joint ventures.”

Oil and gas companies are slow to adopt big data and IoT

Oil and gas companies in North America don’t have as much faith in the potential of big data and the IoT as other industries — with nearly 14 per cent of respondents from Canada and the United States ranking these technologies as below average, compared to only four per cent of global companies with this rank.

The majority (more than 76 per cent) of North American respondents strongly agree or agree that their company has appetite to implement smart technology but lacks the skills and resources — significantly more than the 56 per cent of respondents who said the same globally.