VDMA: European machine vision on course for further success

November 24, 2016

By VDMA

Nov. 24, 2016 – “The machine vision industry in Germany and Europe has been reporting high growth numbers for years. In Germany alone, the turnover has more than doubled within 10 years and an end to the boom is not in sight. In Germany, the sector will achieve a new record turnover of at least 2.2 billion euros this year. The European machine vision industry will record an 8-per-cent increase in turnover in 2016,” said Dr. Olaf Munkelt, chairman of the board of VDMA Machine Vision at the press conference of Vision, a trade show for machine vision worldwide. According to current surveys, the industrial association predicts a further dynamic development of the European machine vision industry also in 2017.

Key component in global race towards automation

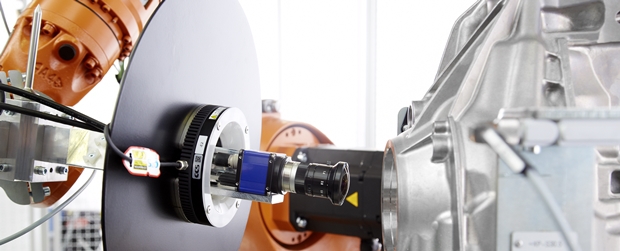

Machine vision “made in Europe” has become the key technology for the automation industry worldwide. Equipped with machine vision, machines are learning to “see and comprehend.” This leads to an improved production quality and in addition to increased productivity and competitiveness in the context of Industry 4.0. Vision technology paves the way for stable and efficient processes as well as flexibility and intelligence in production.

Non-industrial applications gaining ground

Moreover, machine vision is continuously serving new customer industries and expanding into new application areas. “Every year brings new and creative application options: Identification of food products without bar codes at supermarkets, track monitoring at the London Underground, prawn sorting on fishing boats — machine vision proves to be a true all-rounder that has already conquered our everyday lives!” said Munkelt. In 2015, the share of the European machine vision industry in non-industrial sectors already accounted for 24 per cent; the turnover increased by 14 per cent, an above-average growth rate. Intelligent traffic systems, medical equipment, as well as security and surveillance were particularly strong growth drivers.

Automotive industry still the largest customer

Broken down into sectors, the automotive industry is still the world’s largest customer of the European machine vision industry, with a share of 20 per cent of the overall turnover. The turnover of machine vision rose by 9 per cent in 2015. The turnover of all industrial sectors except automotive grew by 8 per cent compared to the previous year. The electrical/electronics industry — including semi-conductors — was the second largest customer with a share of 12 per cent, followed by the metal industry as well as the food and beverage sector with a share of 7 per cent each.

The main driver of growth

For the European machine vision industry, Germany was the major sales market: 33 per cent of the turnover was generated in Germany, 12 per cent more than in the previous year. North America generated 14 per cent and was the second most important export market (an 11-per-cent increase), followed by China with an 8-per-cent share of the turnover (a 16-per-cent increase in comparison with 2014).

Record turnover of cameras

Leading the pack are cameras with a 30-per-cent share of the overall turnover of the European machine vision industry. The turnover rose by a full 9 per cent. With a growth rate of 6.5 per cent, the turnover of machine vision systems was less dynamic.

Conclusion

VDMA has been conducting its market survey on machine vision every year since 1995. This primary research project directly surveys machine vision companies based in Germany and Europe. Both members and non-members of VDMA are included in order to make the results as representative as possible. In 2015, more than 180 companies participated.

Advertisement

- 2016 Ontario Export Awards presented to 11 fast-paced businesses

- Worker injured from handling machinery still connected to power; company fined $80K