Global machine vision market to see recovery in 2024 and beyond: Interact Analysis

February 28, 2024

By Manufacturing AUTOMATION

Image: Interact Analysis

Image: Interact Analysis The global machine vision market is expected to return to growth in 2024 after a slow 2023, according to market intelligence firm Interact Analysis.

In a press statement, the firm shares that while global automation markets have grown, 2023 was a challenging year for machine vision vendors. Total revenues declined from $6.5 billion (USD) in 2022 to $6.3 billion last year. In the wake of this contraction, the market is forecast to record single-digit growth of around 1.4 percent in 2024.

Interact Analysis adds that while price pressures will persist for machine vision vendors in the first half of 2024, order books are expected to start refilling in the second half of the year. The machine vision market is anticipated to recover from 2025 onwards, in line with the firm’s predictions for manufacturing and machinery production growth. Between 2022 and 2028, the machine vision market will grow by an estimated CAGR of 6.4 percent, with revenues increasing from $6.5 billion to $9.3 billion over the forecast period. The Asia-Pacific (APAC) region will be a big driver of this growth.

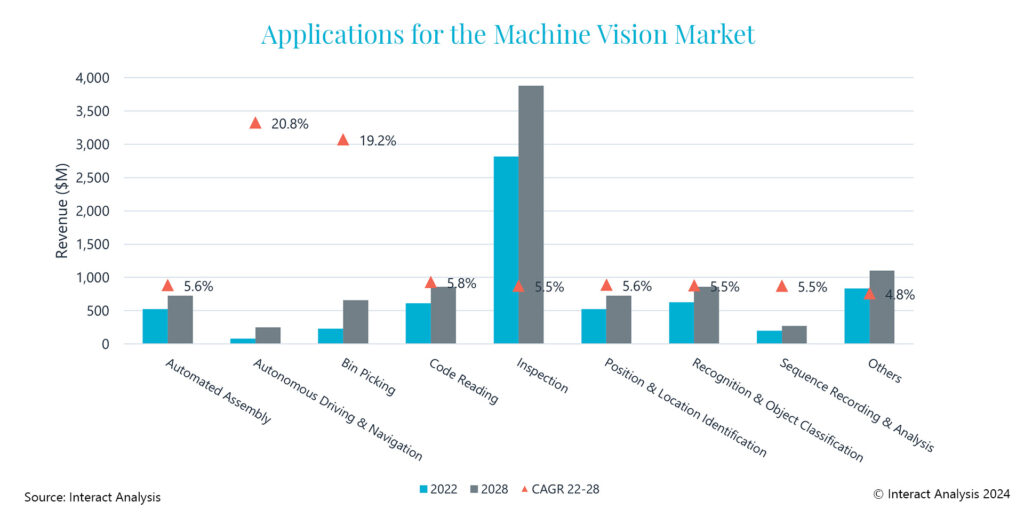

Looking at the market for machine vision by application, inspection is reportedly the dominant segment. It represents over 40 percent of use cases in 2022. By 2028, inspection will be worth around $3.9 billion, predicts Interact Analysis. Resulting from the strong outlook for mobile robots, the autonomous driving segment is forecasted to have the largest CAGR between 2022 and 2028 (20.8 percent), followed by bin-picking (19.2 percent), which will benefit from deployment with industrial robots across a wide range of manufacturing industries.

“The top 3 machine vision vendors, Keyence, Cognex and Teledyne accounted for nearly one-third of global revenues in 2023. Due to the stronger performance of end-customers in APAC, vendors in that region were expected to have had a better year than those with less exposure in 2023. In general, APAC suppliers – particularly those in China – took share from those who conduct more of their business in other global regions,” says Jonathan Sparkes, research analyst at Interact Analysis, commenting on the machine vision vendor landscape. “Despite a plethora of mergers and acquisitions in recent years, the machine vision market is still considered fragmented. New vendors continue to enter the market, with over 200 active worldwide. We are seeing increasing activity from new vendors in China in particular, as well as in those territories where machine vision products are increasingly being used for autonomous driving and bin-picking.”

Advertisement

- Toyota announces car recalls over safety concerns

- Schneider Electric introduces EcoStruxure Plant Lean Management for data-driven decision making