Top five trends in motion control

January 10, 2023

By Treena Hein

A roundup of the latest technology and market trends for 2023

Photo: kynny / iStock / Getty Images Plus / Getty Images

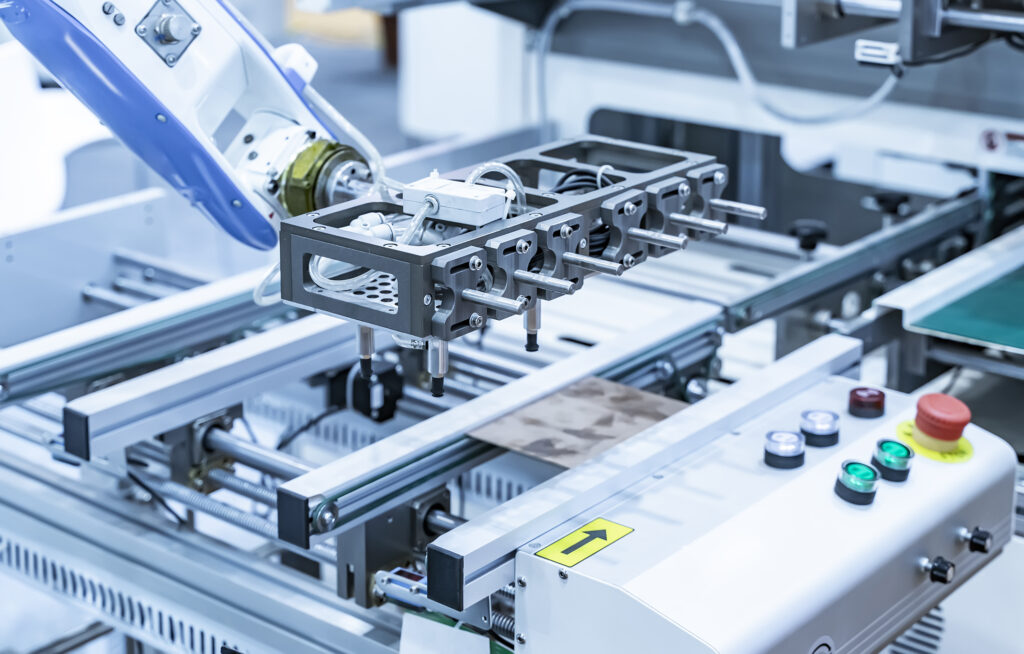

Photo: kynny / iStock / Getty Images Plus / Getty Images Motion control systems – as a whole and their component parts – continue to be updated, along with all other robotic technologies used across manufacturing.

Hot demand is driving healthy competition for new designs. According to Warren Osak, president of Electromate in Vaughn, Ont., demand for motion control is staying at historic levels. This is due to the economic recovery and pent-up demand that’s flowed after pandemic lockdowns, he says, as well as “the rush to automate factories to avoid further production disruptions in the event of future lockdowns.”

Lafert North America also confirms a rising market demand for packaged motor and drive solutions, says Lafert sales engineer Matthew Temple.

Before we do a deep dive into specific motion control system trends for 2023, let’s take a quick look at where demand is hottest. Like many others, Osak points to automated guided vehicles (AVG) and autonomous mobile robots (AMR) as one of the two fastest-growing markets, where technology has to meet the growing and aggressive expectations for speed, positional accuracy and service life. Demand in this area is also high for compact designs that can handle high loads.

Automated vertical indoor farming (‘controlled environment’ crop cultivation in greenhouse or warehouse settings) is the other fastest-growing market, in Osak’s view. “Sophisticated robotic solutions like cartesian systems coupled with a distributed controls architecture are transforming this industry,” he says. “These robotic solutions track the health and quality of the plants, collect plant images for analysis and perform material handling functions.”

Here are the top five trends in motion control systems that will roll out in 2023.

1. Higher performance

According to Temple, motion control systems are trending towards high-performance motors with integrated drive electronics or gear elements.

“Customer partners for both our Industrial Automation and Energy Efficiency business units are demanding power drive system solutions which grant improvements in energy efficiency, space and weight,” he says. “We note the market increasingly demands motor and drive packages which yield these system improvements from reduced investments of time and engineering resources.”

More use of ceramic is also beginning to trend due to the higher performance offered by this material. Osak reports that a few gearbox manufacturers have now replaced case-hardened and steel and alloy gears with ceramic gears. “We’re also seeing ceramic shafts and bits such as pins in gearboxes as well,” he says. “Ceramics have a lot of unique properties, the most important being noise reduction…and they have a lower coefficient of heat expansion, so exhibit less stress than metal alloys when hot. Because ceramic components don’t expand as much, they also have tighter backlash and runout tolerances than comparable internals made of metal.” Osak adds that ceramic subcomponents make particular sense in smaller-frame gearboxes, especially those destined for specialty applications where minimization of noise/vibration and high load capacity are critical.

Osak and his team are also seeing the widespread adoption of Planetary Roller Screws. They’re more efficient than traditional forms of actuation such linear bearing systems and round-rail bearing systems paired with ball screw and acme screw drives, says Osak. “Increasing linear servo-actuator efficiency allows design engineers to use more compact, yet higher thrust, actuators in applications traditionally driven by hydraulic actuation. In fact, electric linear actuators with roller-screw drive mechanisms can in some cases replace hydraulic drives even in very high-powered systems.”

2. Integration

Motion control is trending towards an integrated approach to motors and controls.

As an example, Temple explains that following years of co-engineering battery-powered servo motors and drives with AGV OEMs, his firm launched the ‘Smartris’ system for AGV/AMR wheel drives in 2021. It integrates a drive/controller, servo motor, wheel and ‘Cyclo’ gearbox, targeted at unit load carriers, tow vehicles and assembly line trucks up to about 6500 lbs.

Osak says he is now seeing fully-featured embedded servo drives built into rotary actuators, linear actuators and servo motors. Examples include Maxon’s new IDX motor and Harmonic Drive’s new FHA mini actuator.

There is also increasing demand for finished, integrated sub-assemblies. “Customers who once preferred to do the bulk of their component production assembly in-house are now asking for kitted or bespoke modular sub-assemblies,” says Osak. “The ability to combine multiple motion control components into a customized mechatronic-housed solution provides OEM customers with a means of streamlining their manufacturing process. By reducing the number of SKUs and assembly steps they simplify their production which ultimately saves cost, reduces waste and drives production efficiency.”

3. Standardization

Motion control systems will be affected by continued consolidation and standardization of the industrial ethernet communication protocols, says Temple. “The market is trending towards increased interchangeability and compatibility of components,” he says, “to realize the promised potential of Industry 4.0 and the Industrial Internet of Things.”

Osak points out that the adoption of Codesys as a universal standard for motion control communication is increasing.

4. Power efficiency

As with all other areas of manufacturing, more efficiency is also trending in motion control. Brushless motors, for example, are becoming more popular due to their energy efficiency and heat reduction capabilities compared to AC motors for speed control applications.

On the sensor side, Osak points to the relatively new application of the Wiegand Effect in using pulse energy harvesting to provide battery-less operation of an absolute encoder while still maintaining position information in a power-off state.

In the case of POSITAL’s Wiegand sensors, bipolar magnetic sensing is used without the need for any external voltage or current to be applied. “The material properties of the sensor mean that consistent pulses are produced every time the magnetic field polarity switches,” says Osak. “This makes it the perfect magnetic sensor for low-power and energy-saving applications.”

However, the consistency of the pulses produced by Wiegand sensors can also be used to provide energy for ultra-low power electronics to be operated using a single pulse. “In addition, successive pulses to be stored to offset energy demand of low-power energy circuits,” Osak explains. “Alternatively, the pulses can be used to trigger or ‘wake up’ intermittently-powered electronic circuits. It is also possible for applications to exploit both functions of the pulses (magnetic sensing and energy harnessing), using the pulse energy to power ultra-low power circuits which use the timing of the pulses to perform tasks – for example, count event data.”

Temple adds that their ultra-compact servo motors enable overall length to be decreased by up to 20 percent while torque density is increased by up to 30 percent.

5. Customized solutions

Customization in motion control is nothing new but continues to intensify. Osak says motion control manufacturers would be wise to listen to the voices of their customers and modify their products to better fit customer needs.

One customizable product that Osak is seeing is the turnkey cobot (collaborative robot) application kit. “They’re ideal for end users and integrators because all of the engineering, testing and trial/error have all been done for the customer,” he says. “The synergistic partnerships formed between the robot manufacturers and robotic accessory companies mean the packaged system price helps to keep the buyer’s costs down..But that doesn’t mean a customer is locked into a specific configuration. Each kit is customizable to fit the application needs.”

Another technology supporting increased customization is a frameless motor. Generally compact and lacking traditional housing, these motors lend themselves easily to highly-customized motion control solutions.

This article originally appeared in the November/December 2022 issue of Manufacturing AUTOMATION.

Advertisement

- Complete process control: Essential for continued relevancy in manufacturing

- Galil releases its latest generation single axis motion controller